By: Jeffrey Lapin

At least since October 2012, American Express (“AMEX”) has changed its Cardmember Agreement to permit it to select binding arbitration for consumer disputes. Before this change, cardmembers could select either arbitration or a trial by jury. Now, unless a cardholder opts-out, AMEX can require arbitration.

At least since October 2012, American Express (“AMEX”) has changed its Cardmember Agreement to permit it to select binding arbitration for consumer disputes. Before this change, cardmembers could select either arbitration or a trial by jury. Now, unless a cardholder opts-out, AMEX can require arbitration.

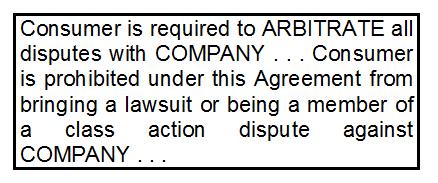

Arbitration is a procedure in which a dispute is submitted to one or more arbitrators who decide the dispute. Binding arbitration means the parties to the arbitration are bound by the decision and cannot appeal or go to court if they disagree with the arbitrator’s decision. AMEX, with the right to decide to arbitrate a dispute, is taking away consumers rights to let a jury decide a dispute.

AMEX “NEW” CARDHOLDER AGREEMENT PROVISIONS

The new language within Amex card agreements provide (formatting and capitalization changed to make text more readable):

Initiation of Arbitration

Any claim shall be resolved, upon the election by you or us, by arbitration pursuant to this Arbitration provision . . .

➢ This Author’s Comment: This provides that AMEX can choose to require arbitration, which they almost always will as they are the ones that are now including it as part of it’s Agreements.

Significance of Arbitration

If arbitration is chosen by any party with respect to a claim, neither you nor we will have the right to litigate that claim in court or have a jury trial on that claim. Further, you and we will not have the right to participate in a representative capacity or as a member of any class of claimants pertaining to any claim subject to arbitration. Except as set forth below, the arbitrator’s decision will be final and binding.

Note that other rights that you or we would have if you went to court also may not be available in arbitration.

➢ This Author’s Comment: These paragraphs basically mean that you if you are “forced” into arbitration you are bound by the decision of the arbitrators and cannot appeal the decision to any court.

Restrictions on Arbitration

If either party elects to resolve a claim by arbitration, that claim shall be arbitrated on an individual basis. There shall be no right or authority for any claims to be arbitrated on a class action basis or on bases involving claims brought in a purported representative capacity on behalf of the general public, other cardmembers or other persons similarly situated.

➢ This Author’s Comment: This provision indicates that you would be prohibited from joining in any class action or other case if AMEX decides it wants to arbitrate your dispute.

OPTING-OUT OF ARBITRATION

American Express is offering consumers the right to opt-out of these arbitration provisions. Current customers have until February 15, 2013, while new customers have forty-five (45) days from the date of their first purchase with their AMEX card. AMEX has provided a rejection/opt-out template for consumers to use to reject these arbitration provisions. This template is available on AMEX site, although it is difficult to find: Arbitration Rejection Notice. While it is not necessary to use the AMEX template, the request to opt-out must include the following information:

I, (Print first and last name of account holder), reject the arbitration provision of my American Express Cardmember Agreement.

My billing address: ____________________________________________________

My American Express Account number(s): _______________ & ______________

______________ Date

____________________________________

(Signature of American Express account holder)

All opt-outs must be sent to:

American Express

PO Box 981556

El Paso, TX 79908

CONCLUSION

Lapin Law Offices would strongly recommend that American Express cardholders opt-out of these arbitration provisions. We have previously blogged about how arbitration favors companies over consumers (Post: Arbitration Clauses Favor Companies Over Consumers). AMEX wants to make arbitration the “default” and require consumes to opt-out to avoid it. This is contrary to our justice system, which specifically provides for a right to jury trial. However, you can “waive” this right and AMEX is hoping you do by inaction.

OTHER BLOGS POSTS YOU MIGHT LIKE

- American Express to Pay Millions in Refunds and Fines

- Discover Bank To Refund $200 Million for Deceptive Marketing

- Protect Yourself From Current Scams: September 2012

- 2011 Consumer Complaint Survey Report Released

- Protect a Deceased Relative from Identity Theft

- Debts Owed By Deceased Relatives: Do Not Pay

ABOUT LAPIN LAW OFFICES

Lapin Law Offices represents clients that have been abused, harassed, threatened, and lied to by debt collectors, telemarketers and credit card companies. You can learn more about your rights by calling us at 402-421-8033 (Lincoln), 888-525-8819 (Toll Free) or submitting your case online: Contact Us. We offer a free initial consultation and do not collect a fee unless we get money for you.