Approximately one year ago, the United States Supreme Court in AT&T Mobility LLC v. Concepcion, upheld forced arbitration clauses and prohibited consumers from pursuing many claims in class action lawsuits. A recent article finds that consumers are disadvantaged by forced arbitration clauses. Companies, not consumers, benefit when disputes are arbitrated rather than litigated and decided by a judge or jury.

WHAT IS ARBITRATION?

Arbitration is “the submission of a dispute to one or more impartial persons for a decision, known as an “award.” Arbitration is considered a streamlined way of resolving a dispute as the normal rules of civil procedure and evidence, which are required in the legal system, are not present and the costs are usually much lower than a trial. Arbitration agreements can have many variations such as: whether the award is binding or non-binding; whether a party has the right to appeal an arbitration award; how the arbitrator(s) are selected; who pays for the arbitrators; and what information, if any, the parties must exchange prior to the arbitration.

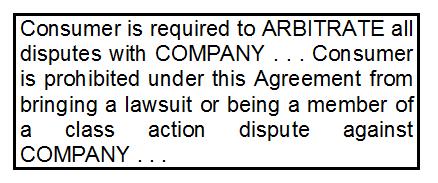

Forced arbitration clauses are used by many companies and corporations. You will find forced arbitration clauses in most contracts such as your cell phone and credit card agreements. These clauses require disputes between a consumer and the company be arbitrated and prevent the consumer from brining a legal action.

Forced arbitration clauses are used by many companies and corporations. You will find forced arbitration clauses in most contracts such as your cell phone and credit card agreements. These clauses require disputes between a consumer and the company be arbitrated and prevent the consumer from brining a legal action.

Forced arbitration clauses almost always favor the company over the individual. The company, in its agreements, not only requires arbitration but sets up the procedures and rules of the arbitration and how the arbitrator is chosen. There is an inherent conflict when a company gets to choose the arbitrator, who has an inherent self-interest to find in favor of the company so they can remain an approved arbitrator and continue to be selected. Also, when the company gets to set the rules of the arbitration, the rules are always set in their favor. Arbitration awards are usually also required to be kept confidential, thus not permitting other consumers to learn about the conduct that started the dispute. Forced arbitration also prevents the bringing of class action lawsuits, which has many benefits to consumers especially in low, per-person damage cases or in cases involving a significant, prevalent harm that should become public to protect and inform all potentially affected consumers.

AT&T MOBILITY LLC V. CONCEPCION

In AT&T Mobility LLC v. Concepcion, the United States Supreme Court extended the reach of the 1925 Federal Arbitration Act (FAA) by upholding forced arbitration clauses, which blocked consumers from bringing class action lawsuits. Prior to Concepcion, some state courts permitted consumers to bring class action lawsuits despite a forced arbitration clause. The FAA’s permitted states to invalidate these clauses based on contract law, and in particular, the doctrines of unconscionability or duress. A contract provision is unconscionable if it is overly one-sided and unfair. The Court in Concepcion stated:

The overarching purpose of the FAA . . . is to ensure the enforcement of arbitration agreements according to their terms so as to facilitate streamlined proceedings. Requiring the availability of classwide arbitration interferes with fundamental attributes of arbitration and thus creates a scheme inconsistent with the FAA.

Furthermore, the majority opinion acknowledged “class proceedings are necessary to prosecute small-dollar claims that might otherwise slip through the legal system,” but, that States “cannot require a procedure that is inconsistent with the FAA.” The ultimate effect of the Concepcion decision made consumers pursue many cases, in which there was a contract that did not permit class actions or required arbitration, on an individual basis rather than as a class. This decision had the double effect of protecting corporations from large verdicts or awards, as claims cannot be consolidated leading to a large dollar amount, and deterred many people from even bringing claims as the costs of pursuing an individual claim can be worth more than the case itself.

The full United States Supreme Court opinion can be read here (AT&T Mobility LLC v. Concepcion, 131 S.Ct. 1740 (2011)).

RECENT ARTICLE FINDS ARBITRATION HURTS CONSUMERS

A recent article, co-authored by the Public Citizen (Public Citizen’s website) and the National Association of Consumer Advocates (NACA) (NACA website), maintains forced arbitration is not good for consumers. The study, Justice Denied: One Year Later: The Harms to Consumers from the Supreme Court’s Concepcion Decision Are Plainly Evident, finds that requiring arbitration over legal action, including class action lawsuits, does not benefit consumers, as was argued by AT&T Mobility in the U.S. Supreme Court’s AT&T Mobility vs. Concepcion case. The article, after examining case studies, statistics and legal decisions, reaches the following conclusions:

Under Concepcion, companies can insert in forced arbitration clauses provisions that block consumers from banding together to pursue their claims in collective or class actions.

Forced arbitration is bad enough on its own terms, as it offers a consumer wronged by corporate misconduct no avenue for relief except a private, secretive tribunal chosen by the company. For millions of consumers in countless instances of corporate wrongdoing, class action bans sweep away even that weak chance for justice. Many consumer claims aren’t feasible as individual actions, and therefore class action bans stop them from proceeding at all. In addition to leaving consumers without remedies for harms done to them, class action bans shield law-breaking companies from accountability. For the companies, this is precisely the point.

Justice Denied is very insightful and consumers wishing to understand more about the effects of arbitration versus court actions, including class actions, should read the entire article, which is available here (Justice Denied One Year Later: The Harms to Consumers from the Supreme Court’s Concepcion Decision Are Plainly Evident).

CURRENT FEDERAL ACTION

Legislation is currently pending in Congress, the Arbitration Fairness Act of 2011, which would limit forced arbitration. The bills are currently stalled in both houses of Congress with the last hearings on the bills being held in October of 2011. You can check the status of the bills on the Library of Congress’ THOMAS system here:

Senate: 112th Congress (2011 – 2012) S.987

House of Representatives: 112th Congress (2011 – 2011) H.R.1873

In addition, the Consumer Protection Financial Bureau (CFPB) announced April 24, 2012, that it is requesting comments about arbitration clauses in financial services and products, such as those found in many bank and credit card agreements. In a press release, CFPB Director Richard Cordray, stated:

Arbitration clauses are found in many contracts for consumer financial products. . . . We want to learn how arbitration clauses affect consumers, and how effective arbitration is in resolving consumers’ issues. This inquiry will help the Bureau assess whether rules are needed to protect consumers.

(Source: Consumer Financial Protection Bureau launches public inquiry into arbitration clauses). The CFPB is specifically requesting comments from the public on the following:

- The prevalence of arbitration clauses in consumer financial products and services;

- What claims consumers bring in arbitration against financial services companies;

- If claims are brought by financial services companies against consumers in arbitration;

- How consumers and companies are affected by actual arbitrations; and

- How consumers and companies are affected by arbitration clauses outside of actual arbitrations.

The CFPB press release also stated:

Companies that use pre-dispute arbitration clauses claim that arbitration is faster and cheaper than litigation, and at least as fair. Others disagree, noting that consumers may not realize that they have waived their right to a trial because of an arbitration clause. And even if consumers understand arbitration clauses, these clauses may still have significant impacts that warrant study by the CFPB.

The public comment period ends on June 23, 2012.

WHAT YOU CAN DO- CALL TO ACTION

Lapin Law Offices urges you to contact your congressional representatives and ask them to support legislation that limits forced arbitration clauses. Nebraskans are urged to contact their United States Congressional Members:

Senator Ben Nelson | Senator Mike Johanns

Representative Jeff Fortenberry | Representative Lee Terry | Representative Adrian Smith

You can also submit letters to congressional members at OpenCongress.org.

In addition, consumers should submit comments to the CFPB about arbitration clauses. The CFPB reference information is: Docket No. CFPB-2012-0017. You can submit comments by any of the following methods:

Electronic: http://www.regulations.gov. Follow the instructions for submitting comments.

Mail/Hand Delivery/Courier: Monica Jackson, Office of the Executive Secretary, Consumer Financial Protection Bureau, 1700 G Street, NW, Washington, DC 20552

RECENT LAPIN LAW OFFICES BLOG POSTS

- Consumers: 11 Ways To Protect Yourself From Scams

- Consumers: Beware Of Scams

- Protect Yourself Against Phantom Debt Collectors

ABOUT LAPIN LAW OFFICES

Lapin Law Offices represents consumers harassed or abused by debt collectors or telemarketers. We believe consumers who are wronged should be able to bring their claims in court. You can learn more about your rights by calling us at 402-421-8033 (24/7) or through our websites: Lapin Law Offices or StopBadCollectors.com for a free consultation.

Lapin Law Offices represents consumers harassed or abused by debt collectors or telemarketers. We believe consumers who are wronged should be able to bring their claims in court. You can learn more about your rights by calling us at 402-421-8033 (24/7) or through our websites: Lapin Law Offices or StopBadCollectors.com for a free consultation.